Subscribe for Free to

Design-2-Part Magazine

Learn how OEMs can make their parts better, faster, and more efficient.

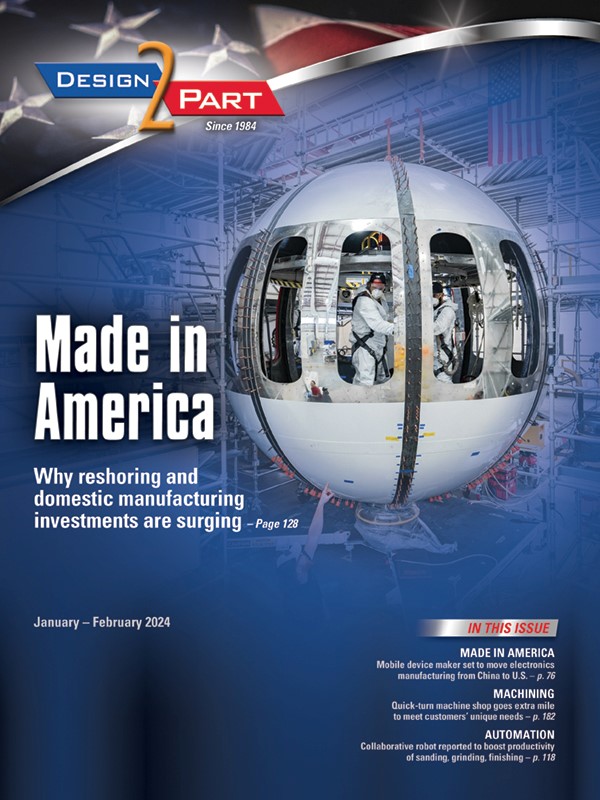

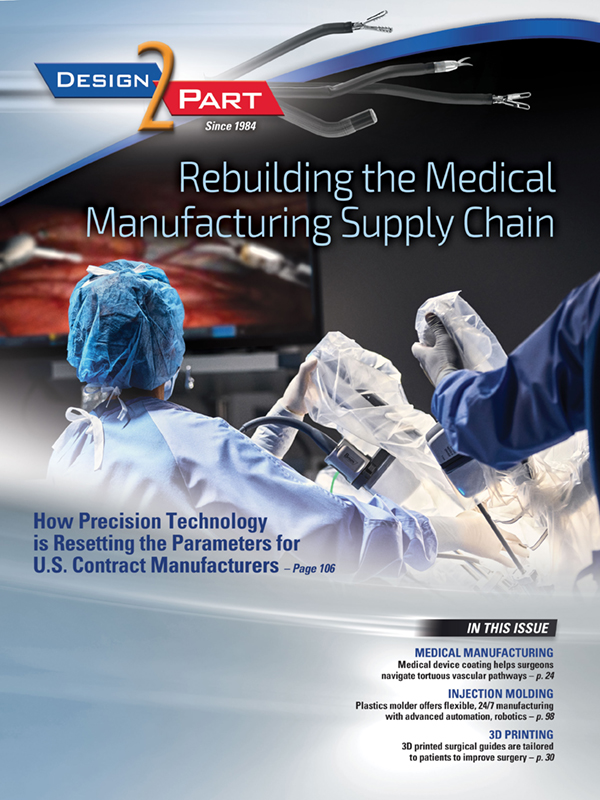

Rebuilding the Medical Manufacturing Supply Chain

How precision technology is resetting parameters for U.S. contract manufacturers

Medical device manufacturers are at the center of a number of trends that are fundamentally reshaping their supply chains. The increasing adoption of innovative, precision technologies in medical systems is causing OEMs and contract manufacturers to be more selective in their partnerships. What new capabilities are contract manufacturers expected to bring to their customers? Find out by reading this story.

Cover photo shows Intuitive Surgical’s DaVinci Surgical System with a vision cart in an operating room. Photo copyright © Intutive Surgical Operations, Inc.

Cover design by Dave Campbell.

Also In This Issue:

• ➜ FROM THE EDITOR

Get expert insight into better, faster, and more efficient ways OEMs make their parts. MORE…

• ➜ TECH UPDATES

Innovative technologies, processes, and services that can help product manufacturers achieve greater productivity or quality. MORE…

• ➜ SOFTWARE & ANALYTICS

The latest software for optimizing product design, development, engineering, and manufacturing. MORE…

• ➜ DESIGN & ENGINEERING

Tools and tips that could help solve engineering problems, jumpstart new designs for better products, and change the way designers and engineers do their jobs. MORE…

• ➜ MADE IN AMERICA

New developments in reshoring, domestic investments in U.S. manufacturing expansion, Foreign Direct Investment (FDI), and Made in USA content. MORE…

• ➜ ADVANCED MATERIALS

Developments in materials that can improve your parts and products — from smart materials to exotic metals and alloys, ceramics, composites, engineered plastics, metamaterials, and more. MORE…

• ➜ ELECTRONICS

Components, circuits, cables, assemblies, electronics manufacturing services (EMS), and more. MORE…

• ➜ INDUSTRY NEWS

News about manufacturing suppliers that OEMs product manufacturers, and sourcing decision makers need to know — plus the latest industry developments and trends. MORE…

Design-2-Part

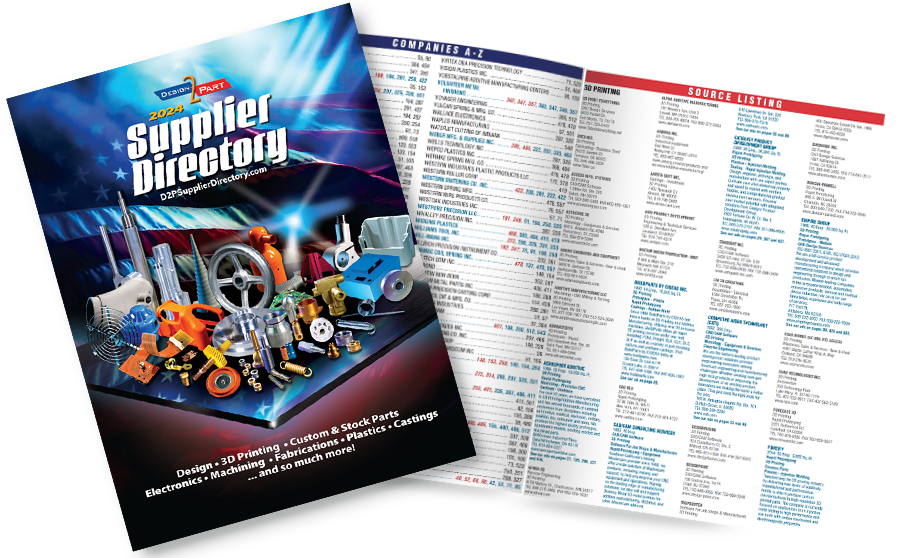

Supplier Directory

The Supplier Directory, published annually

by Design-2-Part Magazine, is the

premier directory of quality

North American manufacturers.

America’s Largest

Design & Contract Manufacturing

Trade Shows

Talk face-to-face with hundreds of American suppliers who can help solve your toughest manufacturing challenges.